Editor’s note: Seeking Alpha is proud to welcome Alan Suchanek as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

luza studios

Introduction

Enthusiasts would describe Bitcoin USD (BTC-USD) as a decentralized digital currency and a store of value, outside the control of any one person and offering diversification outside conventional systems. As a software developer working on bank treasury and blockchain applications, I’m a big proponent of blockchain technology’s potential. However, my enthusiasm is not blind to the limitations and problems found in specific blockchain implementations.

Bitcoin’s 2017 highs, brought my attention to what I consider a critical flaw in Bitcoin’s use of the proof-of-work algorithm. Bitcoin’s excessive energy consumption makes it unsustainable for use as a major cryptocurrency or a store of value. Though I have followed many discussions addressing Bitcoin’s energy consumption since then, some by prominent figures such as Cathie Wood and Elon Musk, I believe the issue remains fundamentally misunderstood. Instead of preserving value, Bitcoin’s inherent design paradoxically destroys it. And no one seems to care.

In this article, I will try to analyse this flaw, challenge the prevailing narratives and offer a perspective based on thought experiments and empirical evidence.

How does Bitcoin work?

Before we get to the promised thought experiment, let’s summarize how Bitcoin works. We will focus only on the key points crucial to our discussion.

Bitcoin is a distributed network of specialized computers (nodes). Each node collects pending transactions, groups them into a block, and locks the block with a special cryptographic hash. A valid hash is very specific in such a way that it can’t be simply computed but needs to be guessed. This guessing requires lots of trials and errors, and these trials require substantial computational power.

After successfully discovering a valid hash, a node broadcasts the new block to the network. The Bitcoin network then verifies the block and appends it to the blockchain. With this, all transactions in the block become valid – executed. The node that found the valid hash is rewarded with newly created Bitcoins. This process is also known as mining, and the node is a miner. In addition to the newly mined Bitcoins, the successful node also receives transaction fees from the transactions included in the block.

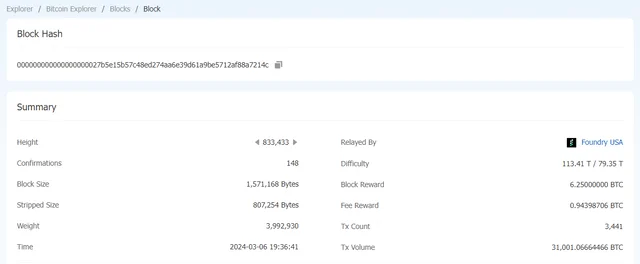

Bitcoin block 833433 with 6.25 BTC reward and 0.94 BTC fee reward (btc.com)

Typically, a block contains around 2,500 transactions. The total reward includes a fixed number of newly mined Bitcoins plus the transaction fees. On average, one block is produced every 10 minutes.

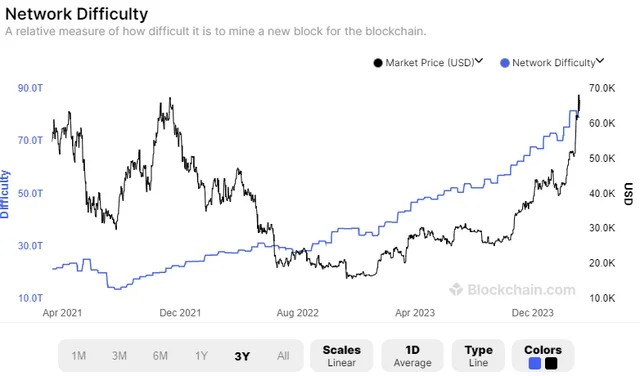

The Bitcoin network automatically adjusts the difficulty of the hash, that is required to secure the block, to maintain these 10 minutes per block timing, regardless of how much computational power is available. Simply said, if the blocks of transactions are being generated too fast, the Bitcoin algorithm increases the hash difficulty, which in turn requires more computational power to guess the right hash and thus requires more time. Restoring the average 10-minute interval between blocks.

As of today, the mining reward is 6.25 BTC, and total fees per block range between 0.1 BTC and 1 BTC. To keep it simple, let’s say that the total reward per block is 7 BTC.

To summarize: approximately every 10 minutes, a new block is created, containing around 2,500 transactions and giving the miner approximately 7 BTC in revenue.

The thought experiment

Let’s do a thought experiment to show how the economics of Bitcoin mining and its energy consumption work. Imagine we have set up a mining operation big enough to consistently mine one block a day. For simplicity, we will assume our daily mining revenue is 7 BTC. Given Bitcoin’s current valuation of $65,000 per BTC, our operation would bring around $455,000 in revenues daily.

To determine our profit, let’s for the sake of an argument assume a 20% profit margin. This is a reasonable assumption given the competitiveness of Bitcoin mining. If profits were significantly higher, it would attract more miners, increasing the network’s computational power. This influx would increase the mining difficulty, as Bitcoin’s protocol adjusts to maintain the average block time at ten minutes, consequently diminishing profit margins. Conversely, if mining was less profitable, miners would exit the industry, reducing competition and difficulty. Those who would remain could enjoy higher margins.

With 20% being our profit margin, the remaining 80% are our operational costs. These are costs for energy consumption and hardware amortisation. Simplifying further, we can assume that the bulk of hardware expenses ultimately translates into additional energy consumption, considering the energy required to mine, transport and transform natural resources to the required hardware. For simplicity, let’s thus say that 80% of the mining reward is spent on energy consumption.

Our operations would then every day collect revenue of $455.000, earn $91.000 of profit, and spend $364.000 on energy.

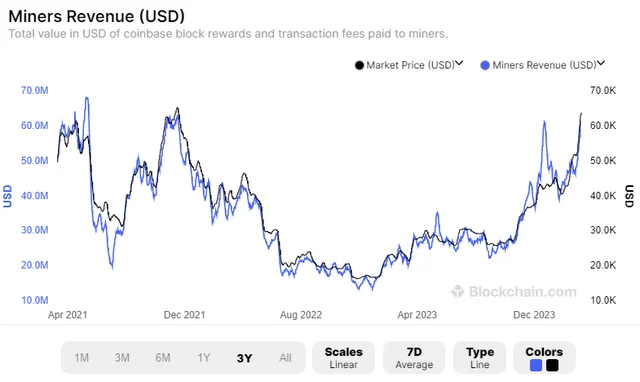

Miners revenue vs Bitcoin price (blockchain.com)

Expanding our analysis to the entire Bitcoin network, which generates approximately 144 blocks daily (24 hours x 6 blocks per hour), we find that the collective daily revenue for all miners amounts to around $65.5 million. Correspondingly, energy expenses sum up to approximately $52.4 million, which translates to about $19 billion annually in energy costs.

$19 billion worth of electric energy a year? Is this too much? In an era where billions are routinely cited in media reports, consider Elon Musk’s $44 billion acquisition of Twitter, we might become indifferent to such large and abstract numbers. The tendency is to rationalize these enormous figures as justified for a system as significant as Bitcoin.

Yet, these costs are ridiculously high when put into perspective. Consider the energy cost per transaction: If an average block encapsulates about 2,500 transactions, with each block incurring $364,000 in energy expenses, the cost per transaction amounts to $145. This expense is extraordinary, especially when considering that Bitcoin, a non-physical asset, could ostensibly cost more to move digitally than sending a physical package across continents.

While individual users don’t directly bear the full $145 transaction fee, since it’s offset by the creation of new Bitcoins, effectively diluting the currency pool, the energy consumed remains real. To offer another comparison, this amount far exceeds what some modern digital banks spend to serve a customer for an entire month, which costs to serve around $1. (check NU Holdings 2023 Q4 Earnings Call Presentation)

Looking ahead to Bitcoin’s future, let’s reference a prediction from ARK Invest’s CEO.

If we adapt our model to this scenario, even as the block reward declines due to halving (to 1.56 BTC per block by 2030, rounded up to 1.6 BTC with the transaction fees), our mining operation’s revenue per block would grow to $2.4 million, and our daily energy costs soaring to $1.92 million for our single operation. Extrapolating to the entire network, this would result in daily revenues of $345.6 million and energy costs of $276.5 million. $101 billion worth of energy is spent annually!

statista.com

At $0.05 per kWh, $101 billion equates to approximately 2,018 TWh of electric energy. To provide context, according to Statista, net electricity consumption worldwide in 2022 amounted to around 25,500 TWh. Thus, if Bitcoin hits Cathie Wood’s forecasted price of $1,500,000 by 2030, its energy consumption would constitute about 8% of worldwide electric energy production. Should Bitcoin reach this price point earlier, say by 2028, its energy usage would escalate to 16% of global production, factoring in Bitcoin halving effects. One might wonder if Cathie Wood actually understands the implications of her forecast.

Bitcoin network difficulty vs Bitcoin price (blockchain.com)

The relationship between Bitcoin’s price, the revenues earned by miners, and the energy consumed are direct: as the price increases, so do miners’ earnings and consequently, their energy expenditures. When Bitcoin’s price reaches sufficiently high levels, it could potentially monopolize affordable energy resources, diverting them from other vital economic and societal needs. Persisting in this energy-intensive endeavour is foolish under any circumstances, but especially so in the context of looming ecological crises. To amplify such a “doom spiral” when facing potential environmental collapse is unmistakably self-destructive.

The Empirical Evidence

Let’s now examine if empirical evidence aligns with the conclusions of our thought experiment.

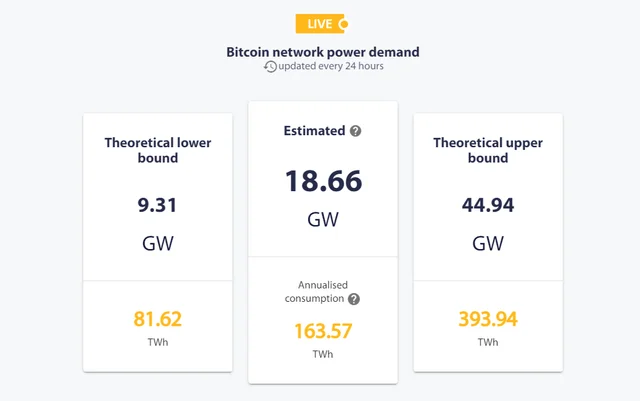

Bitcoin network power demand (University of Cambridge)

First, we refer to the Cambridge Bitcoin Electricity Consumption Index, which estimates the annual power demand of the Bitcoin network at current Bitcoin prices to be 163 TWh, with a theoretical upper limit of 394 TWh. Translated into dollars at $0.05 per kWh, this equates to a range of $8 billion to $24.7 billion. The results of our thought experiment, where we estimated yearly energy consumption worth $19 billion, fall within the upper range provided by the University of Cambridge. Particularly since our experiment considers the total energy footprint, including the energy input in hardware manufacturing, whereas Cambridge’s figures predominantly account for operational energy usage.

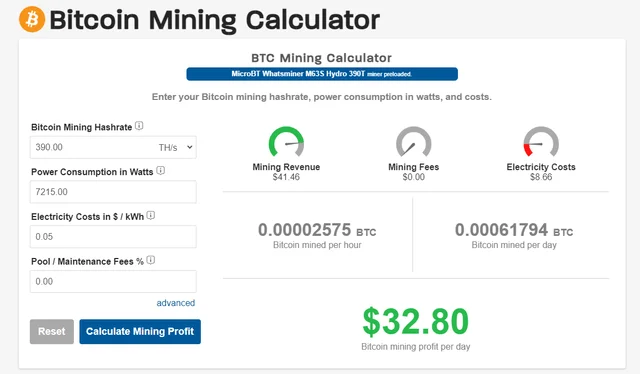

Bitcoin mining profit calculator (coinwarz.com)

For additional insights, let’s turn to the Bitcoin Mining Calculator, which assesses the profitability of various mining hardware setups it sells.

Some devices show profit margins as high as 80%, suggesting that only 20% of revenues are spent on electricity. At first sight, these numbers contradict our thought experiment’s assumptions. However, this discrepancy can be attributed to two main factors.

First, the most recent and efficient mining hardware can indeed temporarily achieve higher profit margins for miners, but as this advanced hardware becomes the standard, the network’s overall mining difficulty adjusts, normalizing profit margins. With the increasing mining difficulty, the efficiency of specific hardware declines over time, aligning long-term profitability more closely with the 20% margin hypothesized in our experiment rather than the initial 80% figure. Eventually, the hardware’s profit margin becomes negative, and the miners dispose of it.

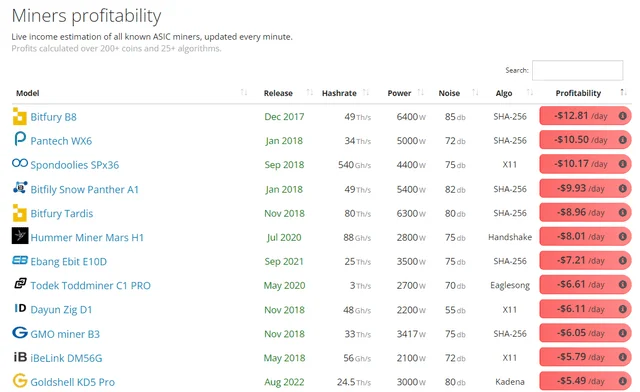

Not all mining hardware is profitable – particularly not the old one (asicminervalue.com/)

The second factor is Bitcoin’s price volatility. The Bitcoin price is currently spiking, and price surges enhance miners’ revenue without increasing operational costs, thus inflating short-term profitability. However, as the network adapts to these changes through more miners joining the fray and consequent increased difficulty, profit margins normalize. Conversely, a rapid decline in Bitcoin’s price can render mining temporarily unprofitable.

In summary, the empirical data largely corroborates the premises and outcomes of our thought experiment. While specific circumstances or cutting-edge hardware can temporarily boost profitability, the long-term economic equilibrium of Bitcoin mining tends towards a scenario where a significant majority of mining revenue, around 80% or more, is allocated to energy costs.

Common Misconceptions

Energy Innovation Feedback Loop Argument: Bitcoin advocates often say that energy innovations will mitigate Bitcoin’s excessive energy consumption. However, imagine a breakthrough that would bring 10 times more energy at 1/10th the costs. What would this do to our hypothetical mining operations? Initially, our mining costs would drop to 8%, boosting our profits to 92%. Yet, this would attract more miners, intensifying competition and increasing the mining difficulty. Ultimately, the network’s energy consumption would multiply 10 times to balance out the reduced costs. Bitcoin, by design, requires that significant resources are consumed (wasted) as proof in its proof of work algorithm. So no matter how abundant or cheap some energy source might be, Bitcoin will consume so much of it, as to make the spent significant in respect to Bitcoins price. Otherwise, the security of its proof of work consensus mechanism can’t be guaranteed.

Green Energy Argument: There are indeed Bitcoin mining operations using renewable energy. This doesn’t inherently negate the broader environmental impact. Renewable energy used for mining is energy not used elsewhere in the economy, serving more critical and essential needs. Bitcoin advocates would argue that these mining operations are in remote regions, where there is no other use for the energy. This is also wrong. It fails to consider global energy dynamics and the transportability of energy-intensive processes like data centres, particularly the very recent and power-hungry AI or the emerging direct CO2 air capture technologies.

More Efficient Hardware Argument: As we have discussed in the empirical evidence section, the newest Bitcoin mining hardware always appears quite efficient and shows a mining profit margin of around 80%, which leads many people to believe that as newer devices get introduced, Bitcoin mining will become more efficient and will consume less energy. This is the wrong conclusion. The newest hardware is only comparatively efficient, and as other miners upgrade to the same or better hardware, the network difficulty increases, and a particular piece of mining hardware becomes less efficient. Again, Bitcoin’s design mandates that significant resources are consumed (wasted) as proof in its proof of work algorithm. Bitcoin’s mining can’t be made efficient by design.

Bitcoin Comparison to Gold: Bitcoin is often compared to gold, with the conclusion that it is just like gold, only better. It is a digital asset, with all the benefits that come with it when storing and transacting it. Indeed, the similarities are quite stinking. But the analogy between Bitcoin and gold fails in at least one critical aspect. While both assets’ mining costs are influenced by their market prices, gold retains its value independently of its mining status. You can stop mining gold and the value of the gold already mined will hold its value, possibly even appreciate more. Conversely, stopping Bitcoin mining would paralyse its network, stripping the currency of its value since transactions would no longer be processed. This critical difference underlines a fundamental flaw in treating Bitcoin as ‘digital gold.’

Bitcoin’s Unique Value Proposition: Bitcoin is often considered as one of its kind, pioneering cryptocurrency with a unique value proposition. When scrutinized, it’s apparent that other cryptocurrencies, particularly those using proof of stake consensus algorithm, offer similar or better functionality without the environmental impact. For instance, Ethereum, with its proof of stake algorithm, consumes a stunning 28,000 times (yes, twenty-eight thousand times) less energy than Bitcoin (6 GWh vs. 170 TWh). Bitcoin’s value is largely narrative-driven, supported by its status and market momentum rather than irreplaceable utility. Transitioning to less energy-intensive cryptocurrencies could yield similar benefits without the associated environmental costs.

Bitcoin Reward Halving Argument: The halving of Bitcoin rewards is considered a future solution to its environmental impact. However, this argument overlooks the fact that Bitcoin’s value has historically risen faster than the halving rate, maintaining or even increasing the incentive for energy-intensive mining. Relying on an asset whose environmental impact depends on its price not growing too rapidly presents a paradoxical situation, especially when the asset is supposed to serve as a store of value.

Investing in Bitcoin ETFs: Investors concerned about Bitcoin’s energy consumption might assume that buying a Bitcoin ETF is not a transaction on the Bitcoin blockchain itself and therefore does not contribute to Bitcoin energy consumption. As we have shown in this article, this is a wrong conclusion. Purchasing a Bitcoin ETF directly affects Bitcoin’s price, and as we have seen, Bitcoin’s price is the single most important factor linearly driving Bitcoin’s energy consumption.

Takeaway

Bitcoin’s energy consumption increases dramatically with its price: at $65,000, it consumes around $52 million worth of energy daily. Should its value double to $130,000, the daily energy spent doubles to $104 million. At a valuation of $1,500,000 by 2030, these costs would be $276 million daily or $101 billion annually. This would represent around 8% of the world’s current annual electric energy consumption.

Many Bitcoin investors might not fully understand that its energy consumption scales linearly with its price. Such a characteristic is undesirable for a digital currency and counterintuitive for an asset meant to serve as a store of value. In their quest to preserve and grow their wealth, Bitcoin investors are unintentionally inflicting damage on the very fabric of society that bestows value upon their assets. This scenario strikingly resembles the fate of Easter Island’s civilization: their relentless endeavour to erect moai statues ultimately caused both environmental degradation and societal downfall.

Eventually, it is likely that either investors or regulators will acknowledge this fundamental flaw in Bitcoin, potentially triggering a rapid devaluation.

Advice to investor

My analysis demonstrates that Bitcoin is an unsustainable store of value and a technically outdated digital currency. Its long-term intrinsic value, considering these factors, will eventually trend towards zero. Each day, Bitcoin maintains a significant valuation that contributes to societal and environmental damage. Therefore, Bitcoin and its ETFs should get a “strong sell” rating.

However, I understand that markets can remain detached from rational evaluations for extended periods. Most investors seek pragmatic and actionable advice rather than an idealistic appraisal. Hence, a “sell” rating is advised for pragmatic purposes.

Investors should gradually sell out of their Bitcoin positions, minimising regrets from missing on the current uptrend, and gradually shift their funds to different assets. If investors want to have exposure to cryptocurrencies, they should strictly avoid all the proof-of-work crypto coins.

Possible flaws in the thesis

The simplifications and rounding errors that I have made during the analysis do not materially alter the overall conclusions. Moreover, the thesis is supported by empirical evidence. Still, it is possible, that I have made an error in my reasoning. I encourage readers to critically examine my reasoning and identify any significant errors that could materially impact conclusions.

The other possible “flaw” could be a fundamental change in Bitcoin’s protocol, such as a migration to a proof of stake consensus algorithm, similar to Ethereum’s transition. But that would not be a flaw of this thesis but a positive development towards Bitcoin’s sustainability. The question though is, how would such a transformation affect Bitcoin’s value? Given Bitcoin’s status as the ‘first and true’ cryptocurrency and its value being narrative-driven, a shift to proof of stake would probably trigger a significant devaluation.