These are the 3 Top Cryptocurrency Exchange Traded Funds (ETFs) to consider purchasing in April 2024, according to analysts on Wall Street. ETFs are investment instruments that comprise a collection of companies within a specific sector, asset class, commodity, currency, or investment approach. For individuals who prefer not to directly invest in cryptocurrencies or crypto stocks, investing in crypto ETFs can be a viable option.

The recent Bitcoin (BTC-USD) halving event, which occurred on April 19, 2024, effectively reduced the block reward for Bitcoin miners by half. Following this event, the reward decreased from 6.25 BTC per mined block to 3.125 BTC per mined block. The purpose of the Bitcoin halving event is to mitigate inflation and regulate the supply of Bitcoins within the crypto ecosystem.

Typically, the Bitcoin halving event is accompanied by a surge in Bitcoin prices. However, this year’s event did not generate as much excitement due to the presence of Spot Bitcoin ETFs, which have helped stabilize the demand and supply dynamics of bitcoins. Since the recent halving event, BTC prices have experienced an increase of approximately 4.6%. Let’s explore the three most promising blockchain ETFs to invest in this April, offering substantial upside potential over the next twelve months.

#1 VanEck Digital Transformation ETF (NASDAQ:DAPP)

The VanEck Digital Transformation ETF monitors the MVIS Global Digital Assets Equity Index, which is a market-cap-weighted index focusing on a selection of global companies involved in the digital asset economy. DAPP’s investment strategy revolves around the belief that these companies are pioneers in the crypto realm and have the capacity to derive at least 50% of their revenue from digital assets. The ETF includes companies engaged in crypto exchanges, mining, and blockchain infrastructure.

Established in March 2021, DAPP’s net asset value (NAV) has witnessed a decline of around 29.2% since its inception. Nonetheless, over the past year, DAPP has recorded a remarkable growth of 149.5%. This equity-oriented ETF currently holds 22 investments valued at $109.48 million. The top five major holdings of DAPP consist of TeraWulf Inc (WULF), Block (SQ), Coinbase Global (COIN), MicroStrategy (MSTR), and CleanSpark (CLSK), collectively accounting for approximately 37.71% of the total portfolio.

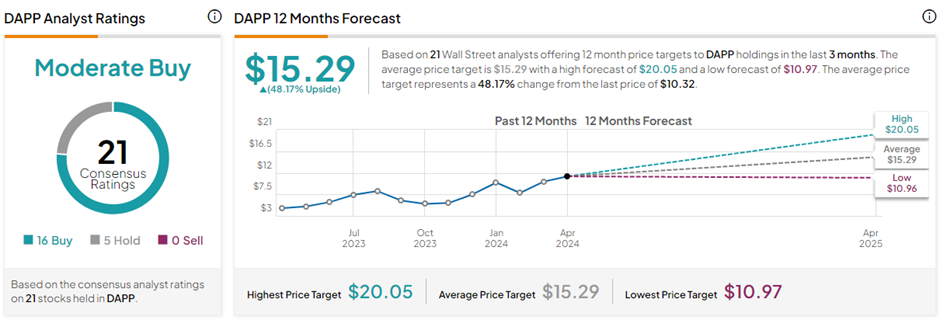

Is DAPP ETF a Sound Investment?

According to TipRanks, DAPP holds a Moderate Buy consensus rating, with 16 Buy recommendations compared to five Holds. The average price target for the VanEck Digital Transformation ETF is $15.29, indicating a substantial upside potential of 48.2% from the current levels.

#2 Fidelity Crypto Industry and Digital Payments ETF (NASDAQ:FDIG)

FDIG is a passively managed fund that mirrors the performance of the Fidelity Crypto Industry and Digital Payments Index, which invests in companies involved in cryptocurrency-related activities, blockchain technology, and digital payments processing.

Launched in April 2022, FDIG has demonstrated a modest gain of 7.5% since its inception. However, over the past year, FDIG has surged by 88%, primarily driven by the escalating cryptocurrency prices. As of March 31, 2024, FDIG comprises 39 holdings with an asset value of $102.11 million. The top 5 holdings of FDIG include Coinbase Global, CleanSpark, Marathon Digital, Riot Platforms, and Cipher Mining (CIFR), collectively representing 44.7% of the portfolio.

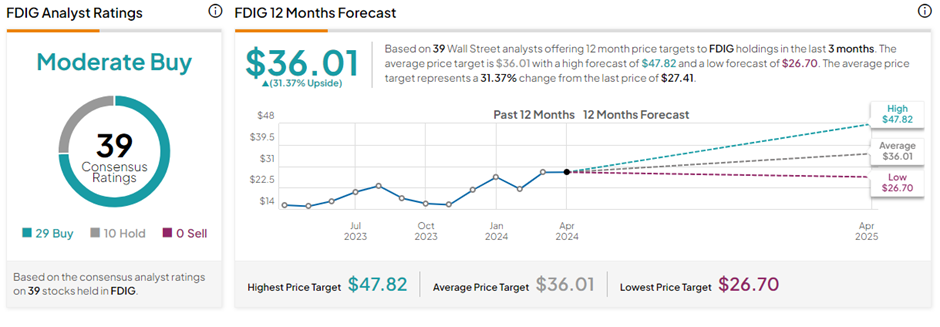

Is FDIG a Buy, Sell, or Hold?

With 29 Buy ratings and 10 Holds, FDIG maintains a Moderate Buy consensus rating on TipRanks. The average price target for the Fidelity Crypto Industry and Digital Payments ETF is $36.01, suggesting a potential upside of 31.4% from the current levels.

#3 First Trust SkyBridge Crypto Industry and Digital Economy ETF (NYSEARCA:CRPT)

CRPT is an actively managed ETF designed to deliver capital appreciation. The fund’s investment strategy involves allocating at least 80% of its net assets to common stocks and American Depositary Receipts (ADRs) of companies associated with the crypto industry and digital economy.

Launched in September 2021, CRPT has experienced a loss of 10.4% since its inception as of March 28, 2024, but has surged by 184.2% over the past year. This equity-focused ETF currently holds 32 investments valued at $52.28 million. The top 5 holdings of CRPT include Coinbase Global, MicroStrategy, Galaxy Digital Holdings (TSE:GLXY), Riot Platforms (RIOT), and Marathon Digital Holdings (MARA), accounting for a significant 75.9% of the total portfolio.

What is the Price Prediction for CRPT ETF?

The average price prediction for the First Trust SkyBridge Crypto Industry and Digital Economy ETF is $16.40, indicating a potential upside of 29.1% from the current levels. Moreover, CRPT boasts a Strong Buy consensus rating on TipRanks, with 27 Buy ratings and five Holds.

Key Highlights

These three crypto ETFs exhibit strong potential for significant growth once cryptocurrency prices begin to gain momentum. Experts are anticipating a substantial uptrend in crypto prices this year. Investors looking to gain exposure to the crypto market may find these ETFs to be a safer and more cost-effective means of achieving diversification.

Disclosure