The Bitcoin halving is coming up next month and that’s caused some increased scrutiny and attention onto Bitcoin and cryptocurrency at large. Most of the news is positive. There are stories of people and companies getting rich as prices climb. Some of it isn’t so good. These include negative downstream effects like scams, global crime and pollution.

The Bitcoin halving refers to a programmed event that occurs approximately every four years on the Bitcoin blockchain protocol.

During this event, the number of new Bitcoins generated with each mined block is cut in half. This reduces the rate at which new Bitcoins are created.

This halving mechanism is built into Bitcoin’s protocol to control its inflation rate and limit the total supply of Bitcoins to 21 million. As a result, the Bitcoin halving is often associated with increased scarcity and has historically impacted the supply and demand dynamics of Bitcoin, potentially influencing its price.

However, influencing the price is something of an understatement. The reality is that in the past few Bitcoin halvings, the price increase has been exponential.

During the first Bitcoin halving on November 28, 2012, the price of Bitcoin stood at approximately $12.25 before the event. Following the halving, the price surged to approximately $127, marking a staggering percentage increase of roughly 936 per cent. This significant price jump underscored the impact of the halving event on Bitcoin’s value, attracting increased attention to the cryptocurrency.

Similarly, the second Bitcoin halving, which occurred on July 9, 2016, witnessed notable price movements. Prior to the halving, Bitcoin was trading at approximately $650. However, post-halving, the price soared to approximately $2,500, representing a percentage increase of roughly 284 per cent. This substantial surge in price reaffirmed the market’s response to the reduced supply of newly minted Bitcoins.

Image via Coingecko.

Bitcoin’s volatility has proven profitable in the long term

The third halving happened on May 11, 2020 after a significant bear market. The price started at approximately $8,700 and kicked off a bull market that saw BTC’s price reach a new all-time high of CAD$86,355.44. At the time of writing, Bitcoin isn’t far off from its all-time high—presently trading at roughly CAD$83K on the headwinds caused by the halving.

These historic price fluctuations following the halving events highlight the significant role that supply dynamics play in shaping Bitcoin’s value. However, it’s these same headwinds that cause so much trouble.

Bitcoin miner Riot Platforms (NASDAQ: RIOT) recommends an abundance of caution because Bitcoin and cryptocurrency investments come with substantial risk.

The firm warns that exposure to financially unstable crypto firms could tarnish the overall market for bitcoin. The collapse of several crypto platforms has already sown distrust within the industry. The predictable effects include increased regulatory scrutiny and a notable decline in the commodity’s value.

The firm also notes that there’s no guarantee that this halving is going to cause the same changes in the price of Bitcoin. That could have some serious downstream effects for both Riot, other miners and Bitcoin mining industry in general.

The company also highlights scaling challenges, such as high BTC fees and slow transaction settlements, which could hinder broader adoption and, consequently, overall demand for bitcoin.

“There is, however, no guarantee that any of the mechanisms in place or being explored for increasing the scale of settlement of cryptocurrency transactions will be effective,” Riot said.

Read more: Marathon Digital Holdings bypasses Bitcoin high transaction scaling issues with Slipstream

Read more: Mastercard and Swoo Pay take mobile payments app to under-served markets

The halving has meant an increase in crime

The halving has its downside, though, as scammers apply strategies to steal money from ignorant but well meaning people.

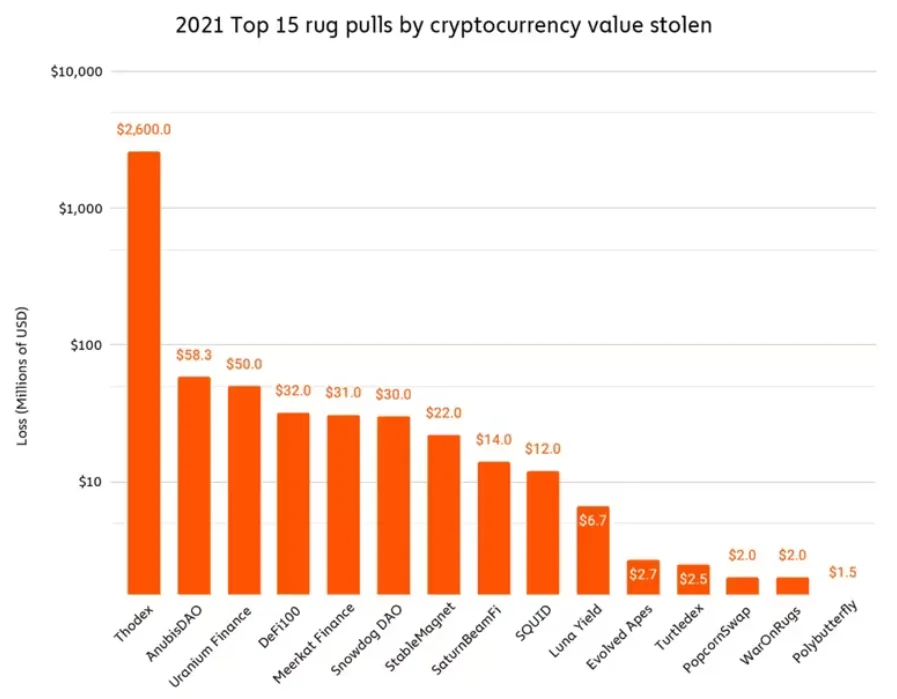

The rug pull scam is one such example.

A rug pull scam is a type of fraud commonly seen in the cryptocurrency space, and particularly within decentralized finance (DeFi) projects. The creators or developers of a cryptocurrency project deliberately withdraw liquidity or funds from the project. As a result, the value of the cryptocurrency plummets and investors lose substantial amounts of money.

The term “rug pull” metaphorically describes the sudden and unexpected removal of the rug from under the feet of investors, leaving them with worthless or significantly devalued tokens. Rug pull scams often occur after the project has gained traction and attracted significant investment.

Rug pull scams can take various forms, but they typically involve deceptive practices by the project’s creators, such as promising high returns, manipulating token prices, or providing false assurances of security and transparency. The criminals pull the metaphorical rug out from underneath investors by absconding with the funds and closing the project.

Due to the pseudonymous nature of many cryptocurrency projects and the lack of regulatory oversight in the decentralized space, rug pull scams can be challenging to prevent and prosecute, making investors vulnerable to significant financial losses. As such, investors should exercise caution and conduct thorough research before investing in any cryptocurrency project to mitigate the risk of falling victim to a rug pull scam.

Chart from Chainanalysis.

RiskOnBlast project is latest rug pull

Arkham Intelligence suspects the RiskOnBlast project, a gambling platform operating on the Blast layer-2 ecosystem, is the latest rug pull and the first on the platform.

This suspicion arises from the disappearance of its funds, website, and social media presence. On February 25, RiskOnBlast balances had plummeted to zero, indicating that the funds had been siphoned out.

On Sunday, blockchain investigator Amir Ormu reported that the RiskOnBlast team had laundered USD$850,000 of the stolen funds using ChangeNOW as a mixer to hide the transaction trail. Additionally, they sent funds to the MEXC and Bybit exchanges.

Rug pulls aren’t the only type of scam out there.

A “pig butchering scam” in the context of cryptocurrency refers to a type of fraudulent scheme where individuals or groups exploit investors by manipulating the value of a particular cryptocurrency or token for their own gain. The term “pig butchering” suggests a ruthless and systematic exploitation of investors, akin to the process of butchering a pig for its meat.

In this scam, perpetrators typically engage in activities such as pump-and-dump schemes, where they artificially inflate the price of a cryptocurrency through coordinated buying and hype, only to sell off their holdings at the inflated price, leaving other investors with significant losses as the price rapidly drops. Alternatively, they may engage in other forms of market manipulation, spreading false information or creating artificial demand to drive up prices before selling off their holdings.

The “pig butchering” aspect underscores the predatory nature of these schemes. They involve luring unsuspecting investors into investing based on false promises or manipulated market conditions, ultimately resulting in financial harm for those who fall victim to the scam.

Read more: Hive Digital mines 830 Bitcoin in Q1 despite high mining difficulty

Read more: Alberta electricity generator fined for bypassing regulatory approvals

Pig butchering scams masquerade as romance scams

Romance scammers initiate contact by building a relationship over time with the victim, typically in a romantic manner, as suggested by the name. They often start by pretending to have texted a wrong number or through dating apps.

As the relationship progresses, the scammer gradually convinces the victim to invest money, sometimes in cryptocurrency and sometimes in fiat, in a fictitious investment opportunity. This manipulation continues until the scammer ultimately cuts off contact with the victim.

According to the FBI’s 2022 IC3 Report, Americans reported losses of over $700 million to romance scams in both cryptocurrency and fiat in 2022. Additionally, individuals reported losses of nearly $2.5 billion to crypto investment scams of any kind, regardless of whether there was a romance element. These figures also do not include victims in other countries, such as China, where residents are heavily targeted in similar schemes.

There’s another peculiar angle to these types of scams as well.

Pig butchering scams involve kidnapping, trafficking, and forcing individuals throughout China and Southeast Asia to work in labour camps within large compounds. These individuals carry out the scams. Cities like Myawaddy in Myanmar are hot spots for this activity, as political instability there permits pig butchering gangs to operate with impunity.

Organizations involved take crypto payments from scam victims, but also will often make the families of trafficked workers to pay ransoms in exchange for their family member’s freedom in cryptocurrency.

pic.twitter.com/uftcGq2nMs

— SCARS Information & Support For Scam Victims (@RomanceScamsNow) February 18, 2024

Canadians lost $309 million in 2023

The Canadian Anti-Fraud Centre reported that investment scams resulted in Canadians losing $309 million in 2023.

Jason Tschetter established Fraud Hunters Canada after losing CAD$81,000 to a cryptocurrency scam.

“We encounter clients who have lost $700,000 or $7,000. It varies depending on what scammers can extract from people,” said Tschetter.

Tschetter highlighted the scarcity of services available to cryptocurrency fraud victims.

Fraud Hunters Canada will rebrand as Cyber Crime Victim Service this month, aiming to provide assistance to individuals affected by cyber fraud.

“They face suicide attempts, financial ruin, divorce; it’s a harrowing experience for many who reach out to us,” said Teschetter.