Blockchain pioneer and Bitcoin (BTC) platform Coinbase Global (COIN) has faced challenges in upward momentum this quarter, with a 19% decline in April and a 25% drop from its two-year peak of $283.48 on March 25. However, there is potential for a turnaround as COIN approaches a historically bullish trendline.

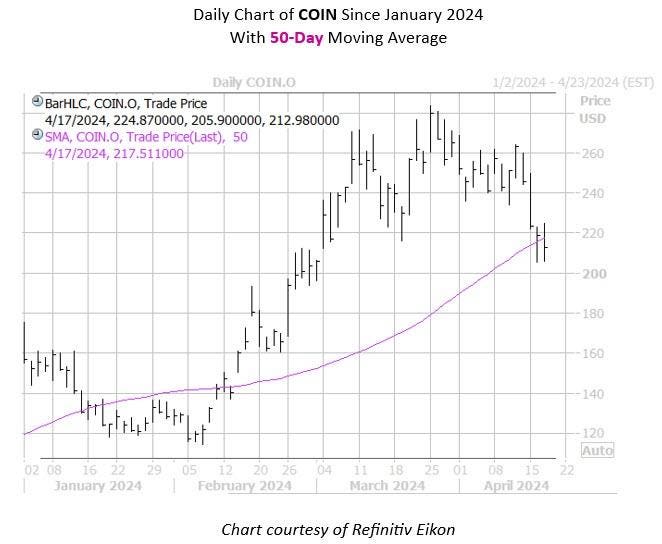

According to insights from Senior Quantitative Analyst Rocky White, COIN has neared its 50-day moving average within one standard deviation after an extended period above it. Over the past three years, there have been three similar occurrences, with COIN trading higher one month later 67% of the time, boasting an average gain of 11%. Should this trend repeat, a comparable increase from its current level of \(212.27 could propel the stock to around \)235.61.

Furthermore, a potential short squeeze might contribute to a rebound. Despite a 10% decrease in short interest during the last two reporting periods, the 11.63 million shares held short represent a substantial 6.3% of COIN’s total float. Despite the recent downturn, the security has surged by 22% in 2024, suggesting that a rally could prompt analysts to reassess their outlook; currently, 12 out of 20 analysts covering COIN maintain “hold” or lower ratings.

Considering the elevated Schaeffer’s Volatility Scorecard (SVS) of 76 out of 100 for Coinbase Global stock, options present an attractive opportunity. This score indicates that the stock has surpassed option traders’ volatility projections over the past year, making it advantageous for buyers seeking premium opportunities.