Bitcoin (BTC), the oldest and most valued cryptocurrency in the world, managed to rise above the $73,000 mark early Thursday, as the BTC exchange-traded funds keep fuelling excitement among investors. Ethereum (ETH), which was on a roll due to the Dencun Upgrade, dropped below the $4,000 mark after the upgrade went live last night. It remains to be seen how ETH manages to recover. Other popular altcoins — including the likes of Dogecoin (DOGE), Ripple (XRP), Solana (SOL), and Litecoin (LTC) — saw a mix of minor dips and gains across the board. Memecoin dogwifhat (WIF) became the biggest gainer, with a 24-hour jump of over 32 percent. NEAR Protocol (NEAR), on the other hand, turned out to be the biggest loser, with a 24-hour dip of over 7 percent.

The global crypto market cap stood at $2.77 trillion at the time of writing, registering a 24-hour gain of 1.43 percent.

Bitcoin (BTC) Price Today

Bitcoin price stood at $73,505.47, registering a 24-hour gain of 2.02 percent, as per CoinMarketCap. According to Indian exchange WazirX, BTC price stood at Rs 63.10 lakh.

Ethereum (ETH) Price Today

ETH price stood at $3,991.25, marking a 24-hour dip of 1.08 percent at the time of writing. As per WazirX, Ethereum price in India stood at Rs 3.45 lakh.

Dogecoin (DOGE) Price Today

DOGE registered a 24-hour gain of 9.84 percent, as per CoinMarketCap data, currently priced at $0.1712. As per WazirX, Dogecoin price in India stood at Rs 15.95.

Litecoin (LTC) Price Today

Litecoin saw a 24-hour dip of 2.07 percent. At the time of writing, it was trading at $96.01. LTC price in India stood at Rs 8,349.99.

Ripple (XRP) Price Today

XRP price stood at $0.6836, seeing a 24-hour dip of 1.67 percent. As per WazirX, Ripple price stood at Rs 59.38.

Solana (SOL) Price Today

Solana price stood at $166.45, marking a 24-hour gain of 11.55 percent. As per WazirX, SOL price in India stood at Rs 14,300.

Top Crypto Gainers Today (March 14)

As per CoinMarketCap data, here are the top five crypto gainers over the past 24 hours:

dogwifhat (WIF)

Price: $2.91

24-hour gain: 32.03 percent

Jupiter (JUP)

Price: $0.9458

24-hour gain: 17.36 percent

Bonk (BONK)

Price: $0.00003442

24-hour gain: 17 percent

Pancakeswap (CAKE)

Price: $4.93

24-hour gain: 15.51 percent

Pepe (PEPE)

Price: $0.00001017

24-hour gain: 15.43 percent

Top Crypto Losers Today (March 14)

As per CoinMarketCap data, here are the top five crypto losers over the past 24 hours:

NEAR Protocol (NEAR)

Price: $7.84

24-hour loss: 7.11 percent

Toncoin (TON)

Price: $4.09

24-hour loss: 6.62 percent

Sei (SEI)

Price: $0.8787

24-hour loss: 6.08 percent

Bittensor (TAO)

Price: $639.42

24-hour loss: 5.80 percent

WEMIX (WEMIX)

Price: $3.28

24-hour loss: 4.95 percent

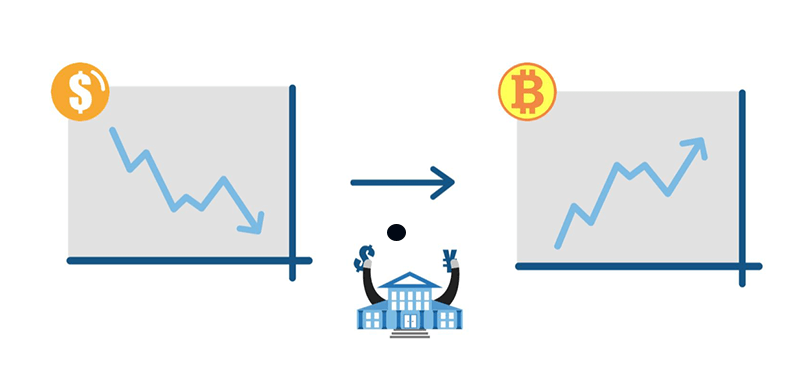

What Crypto Exchanges Are Saying About Current Market Scenario

Mudrex co-founder and CEO Edul Patel told ABP Live, “Bitcoin has skyrocketed to $73,000, registering a 47% surge over the last month and 199% increase over the past year. This upward momentum is credited to the growing interest in Bitcoin spot ETFs and the impending Bitcoin halving event, which historically triggers significant price movements. There has been a steady increase in mainstream acceptance and investments from both retail and institutional investors following the approval of Bitcoin spot ETFs. Now that Bitcoin has breached the $73,000 threshold, the market eyes at the $76,000 level. BlackRock’s Bitcoin ETF has rapidly outpaced MicroStrategy in accumulating Bitcoins, accumulating nearly 204,000 BTC within just two months of its launch, indicating a surge in demand. Blackrock’s Bitcoin holdings now stand at over $14.76 billion in assets under management.”

CoinSwitch Markets Desk noted, “The global crypto market cap has reached $2.77 trillion, marking a 1.69% increase from yesterday. With another day of BTC hitting all-time highs, the fear and greed index has now moved into the extreme greed category, meaning a correction is due and sooner or later the bears are going to have a good day at the market. However, with bulls having full control of the market currently, top altcoins namely BNB and SOL have been competing for the fourth largest crypto after BTC, ETH and USDT. Yesterday the ETH Dencun upgrade went live, which will have a positive impact on layer 2 gas fee transactions. Though MATIC reached its highest price in more than a year – similar price action was not visible in OP and ARB.”

Rajagopal Menon, Vice President, WazirX, said, “Bitcoin (BTC) continues its upward trajectory, hitting new all-time highs amid rapid buy-ups after each dip. However, analysts suggest a cooling phase may be on the horizon as BTC has nearly doubled in price since late January without significant pullbacks. Negative bearish divergence on the 4-hour chart’s relative strength index (RSI) hints at potential lower prices. Meme coins’ soaring values indicate a possible pullback, with BTC trading around $73,192, up 1.40% in the last 24 hours.”

Sathvik Vishwanath, CEO and co-founder of Unocoin, said, “On March 13, Bitcoin jumped to around $73,000, supported by a solid base with a pivot point at $70,013 and resistance levels between $73,824 and $79,904. Key support levels at $67,154, $64,861 and $62,192 offer a safety net against potential downside. Technical indicators, including the relative strength index (RSI) of 71 and the 50-day exponential moving average (EMA) at 68,547, indicate strong buying interest, reinforced by bullish candlestick patterns. A break above $72,000 could sustain the bullish trend, while a break below could prompt a re-evaluation. However, caution is advised if the price drops below $72,000, potentially signalling a shift in trend despite the current optimism.”

Shivam Thakral, CEO of BuyUcoin, said, “Bitcoin continues to rally after a week of record spot ETF net inflows of $1.1 billion. MicroStrategy which recently bought $821.7 million worth of bitcoin, is now raising $500 million more to buy additional Bitcoin.This price action reflects strong institutional buying and new ATHs don’t take much time unlike earlier. $74,000 is the next price level to watch before it eventually hits 100,000.”