The “Cryptocurrency Payment Apps Market by Cryptocurrency Type (Binance Coin, Bitcoin, Cardano), End Use (Businesses, Individuals) – Global Forecast 2024-2030” report has been added to 360iResearch.com’s offering.

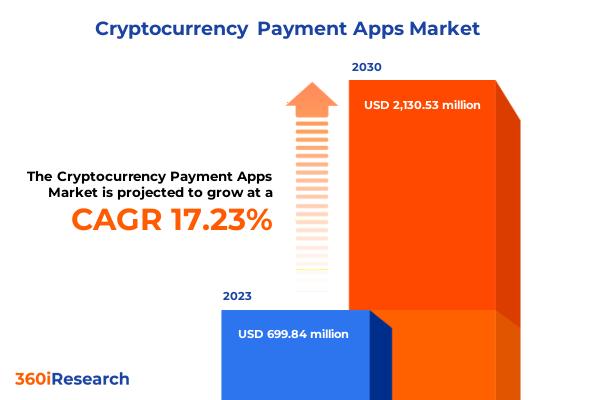

The Global Cryptocurrency Payment Apps Market to grow from USD 699.84 million in 2023 to USD 2,130.53 million by 2030, at a CAGR of 17.23%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/cryptocurrency-payment-apps?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Cryptocurrency payment apps comprise digital platforms and applications facilitating transactions with cryptocurrencies instead of traditional fiat currencies. These apps enable the purchase, sale, storage, and transfer of various digital assets, such as Bitcoin, Ethereum, and Litecoin. Cryptocurrency payment methods include mobile wallets, merchant tools for accepting crypto payments, multi-cryptocurrency exchange platforms, and cross-border remittance services software solutions. These apps cater to individuals and businesses, offering wallet management, instant exchange between currencies, QR code scanning for payments, real-time price tracking, user-friendly interfaces, and advanced security measures. The growing adoption of digital payments and mobile wallets and several government initiatives to adopt cryptocurrency payments consistently create a stronger landscape for the global cryptocurrency payment apps market. Furthermore, the increasing adoption of cryptocurrencies by individuals and businesses and efficient and cost-effective cross-border transactions collectively contribute to market growth. However, in some regions, uncertainties in cryptocurrency bills and uneven regulations hamper the adoption of cryptocurrency payment apps. Moreover, the continuous advancements in blockchain technology and the growing adoption of new cryptocurrencies as payment options are expected to boost the adoption of cryptocurrency payments. In addition, emerging partnerships between cryptocurrency payment platforms and several businesses across categories create lucrative scope for the market.

In the Americas, the adoption of cryptocurrency payment apps has been growing at a greater pace with the increasing popularity of cryptocurrency as an alternative payment method. People increasingly adopt cryptocurrencies such as Bitcoin, Ethereum, and Litecoin for online transactions and settling payments at physical stores. Governments in countries such as the United States have begun implementing cryptocurrency regulations, resulting in more businesses offering crypto-related services and accepting digital currencies as a legitimate form of payment. In the Asia-Pacific, the burgeoning eCommerce industry combined with widespread smartphone penetration has increased demand for secure and efficient mobile-based payment solutions. Countries such as Japan and South Korea have emerged as pioneers in adopting blockchain technology; their progressive regulatory stance toward cryptocurrencies has encouraged businesses to embrace them as viable means of transaction. Additionally, the remittance market in Asia-Pacific is another niche sector where cryptocurrency payment apps have gained prominence. In the EMEA region, there has been a steady growth in the adoption of cryptocurrency payment apps owing to increasing awareness about cryptocurrencies and their potential use cases. Europe’s well-established fintech ecosystem has provided a conducive environment for startups and businesses focused on digital currency solutions. In the Middle East and Africa region, while the adoption of cryptocurrency payment apps remains comparatively low, there are still promising signs of growth. Countries such as UAE and Bahrain have taken initiatives to introduce regulations around digital assets, encouraging businesses to explore opportunities in this domain.

Market Segmentation & Coverage:

This research report categorizes the Cryptocurrency Payment Apps Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Cryptocurrency Type, market is studied across Binance Coin, Bitcoin, Cardano, Dai, Dogecoin, Ethereum, Litecoin, Polygon, Ripple, Solana, and Tether. The Ripple is projected to witness significant market share during forecast period.

Based on End Use, market is studied across Businesses and Individuals. The Businesses is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 41.13% in 2023, followed by Europe, Middle East & Africa.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/cryptocurrency-payment-apps?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Cryptocurrency Payment Apps Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Cryptocurrency Payment Apps Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Cryptocurrency Payment Apps Market, highlighting leading vendors and their innovative profiles. These include ALX Crypto, Apirone OÜ, Binance, BitPay Inc., Blockonomics, Boxcoin, Cash App by Block, Inc., Circle Internet Financial Limited, Coinbase, CoinGate, Coinify ApS, Coinremitter pte ltd., CoinsPaid, CoinZoom, Inc., Cryptomus, Cryptopay Ltd., Electroneum Limited, Hoodpay LLC, MYCELIUM, NOWPayments, Paymium SAS, PicPay, SecuX Technology Inc., Stripe, Inc., Wirex Digital D.o.o, and ZuPago HyBrid (HD) Wallet.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Cryptocurrency Payment Apps Market, by Cryptocurrency Type

7. Cryptocurrency Payment Apps Market, by End Use

8. Americas Cryptocurrency Payment Apps Market

9. Asia-Pacific Cryptocurrency Payment Apps Market

10. Europe, Middle East & Africa Cryptocurrency Payment Apps Market

11. Competitive Landscape

12. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Cryptocurrency Payment Apps Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Cryptocurrency Payment Apps Market?

3. What is the competitive strategic window for opportunities in the Cryptocurrency Payment Apps Market?

4. What are the technology trends and regulatory frameworks in the Cryptocurrency Payment Apps Market?

5. What is the market share of the leading vendors in the Cryptocurrency Payment Apps Market?

6. What modes and strategic moves are considered suitable for entering the Cryptocurrency Payment Apps Market?

Read More @ https://www.360iresearch.com/library/intelligence/cryptocurrency-payment-apps?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India – 411014.

[email protected]

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset – our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.