The dollar amounts are staggering.

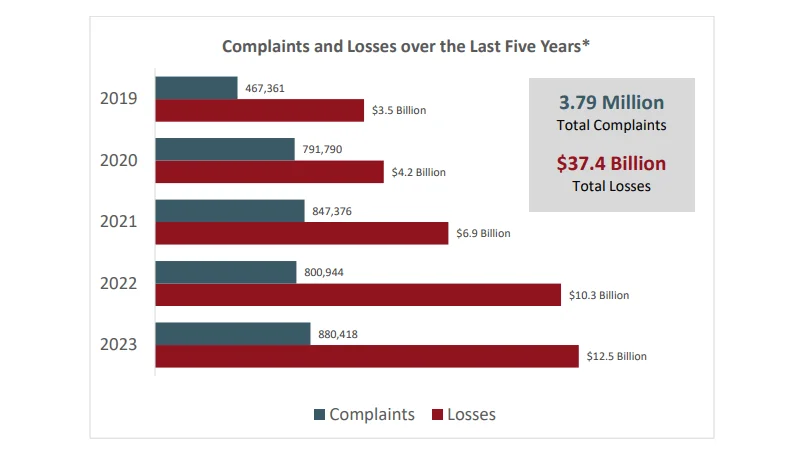

According to a new report from the Federal Bureau of Investigation, Internet financial crime in the United States reached $12.5 billion in 2023, a 22% increase over the prior year.

The data was compiled by the FBI’s Internet Crime Complaint Center (IC3), which allows the public to report cybercrime directly to the agency. It lodged 880,418 complaints in 2023, a 10% increase over 2022.

The $12.5 billion in losses, the FBI says, is “conservative” because many crimes go unreported.

“Today’s cyber landscape is threatened by a multitude of malicious actors who have the tools to conduct large-scale fraud schemes, hold our money and data for ransom, and endanger our national security,” says Timothy Langan, the FBI’s Executive Assistant Director. “Profit-driven cybercriminals and nation-state adversaries alike have the capability to paralyze entire school systems, police departments, healthcare facilities, and individual private sector entities.”

The FBI found that the most commonly reported cybercrime in 2023 was the classic “phishing” scam, in which users receive unsolicited emails asking for personal and financial information. Other examples include personal data breaches, extortion, tech support scams, and non-payment or non-delivery of products.

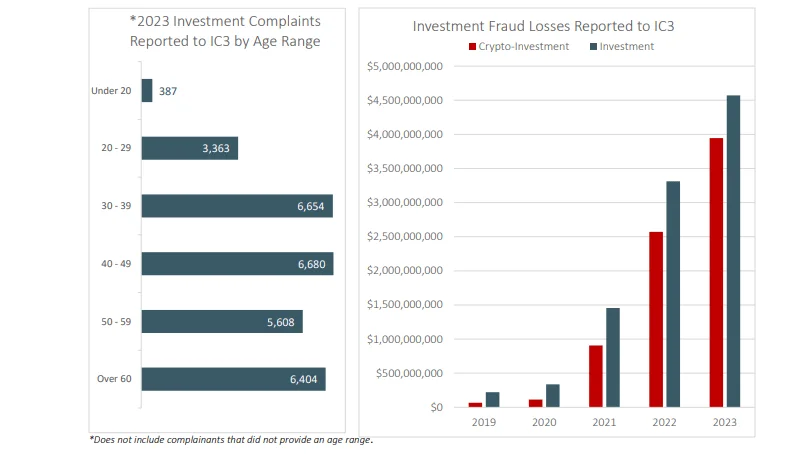

But the costliest crimes by dollars, and the fastest growing, are investment scams – specifically cryptocurrency fraud.

FBI data show that investment fraud losses soared 38%, from $3.31 billion in 2022 to $4.57 billion in 2023. Crypto scams alone rose 53%, from $2.57 billion to $3.94 billion.

In a March 2023 alert, the FBI explained how these crimes typically play out.

The FBI said criminals use fictitious identities to develop relationships and build rapport with victims through social media platforms, dating apps, and professional networking sites.

“Once trust is established with victims, criminals introduce the topic of cryptocurrency and claim to have expertise or an affiliation with experts who can help potential investors achieve financial success.”

At that point, the criminals often share info on fictitious profits and then convince them to invest through fraudulent websites or apps.

“It goes without saying, but I’ll say it again: There are no sure things in the investment world. Crypto is a highly speculative investment that critics say has all the earmarks of a Ponzi scheme,” says KTLA 5 News consumer reporter David Lazarus. “All would-be investors should carefully do their homework before giving money to anyone. If you’re hot for crypto, go through an established exchange, not some guy you encountered on social media.”

California is the nation’s most populated state, so it is not surprising that it also had the highest total losses to cybercrimes in 2023: $2.16 billion. Texas ($1.02 billion), Florida ($875 million), New York ($750 million) and New Jersey ($441 million) comprise the top 5.

The FBI’s report spells out not only the scope of the problem but also the agency’s response. Through its Recovery Asset Team (RAT), the FBI says it has frozen funds of criminal organizations and returned hundreds of millions of dollars to victims.

PROTECTING YOURSELF FROM INVESTMENT FRAUD (FBI):

- If an unknown individual contacts you, do not release any financial or personal identifying information (PII), and do not send any money.

- Do not invest based solely on the advice of someone you meet online.

- Confirm the validity of any investment opportunity or cryptocurrency investment website or app.

- If you have already invested funds and believe you are a victim of a scheme, you do not have to pay any additional fees or taxes to withdraw your money.

- Do not pay for services that claim to be able to recover lost funds.