Less than ten days remain until the approaching milestone in the cryptocurrency realm: Bitcoin’s halving event. This significant occurrence is poised to exert a substantial influence on the sector, given recent advancements related to the primary digital asset. These advancements encompass the rise of spot Bitcoin exchange-traded funds (ETFs) and the evolving regulatory landscape for digital assets.

Bitcoin’s deflationary mechanism hinges on the forthcoming halving event, recurring approximately every four years. This process effectively halves the block reward, thereby constricting the influx of new tokens. Consequently, with each halving, the availability of Bitcoins in circulation diminishes, fostering scarcity.

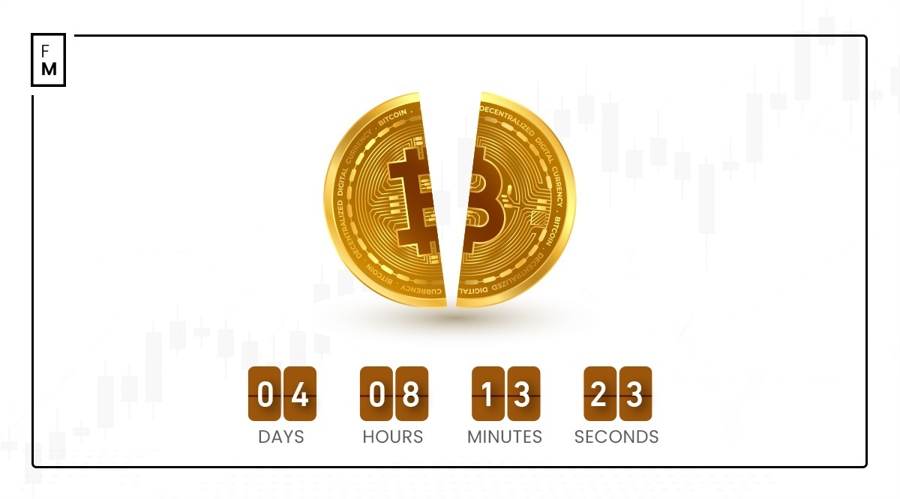

The imminent halving will slash the block reward from 6.25 Bitcoins to 3.125 Bitcoins. Historically, such halving events have triggered spikes in Bitcoin’s value. Moreover, the anticipation leading up to the event often stimulates heightened trading volumes and price fluctuations. As per Binance’s countdown, the halving event is merely four days away, although pinpointing the exact date remains challenging.

Source: Binance

Bitcoin’s Hashrate Resilience

As outlined in a Coindesk report, analysts foresee a modest decline ranging between 5% and 10% in Bitcoin mining hashrate post-halving. This dip is attributed to the prevailing profitability levels in mining and the rapid adoption of efficient mining hardware.

Despite short-term fluctuations, the hashrate is anticipated to promptly recover, underscoring the industry’s resilience. Miners utilizing costly equipment face the imperative to upgrade to more efficient models to sustain profitability. The introduction of advanced, energy-efficient machines necessitates a strategic realignment. Hence, it is imperative for miners to adapt to the shifting market dynamics.

Reports indicate that certain miners are contemplating diversification into alternative sectors, mirroring the competitive landscape of the mining domain. Additionally, there is a discernible trend towards geographical decentralization, with miners exploring novel, cost-effective sites for their mining operations. The ramifications of the Bitcoin halving transcend mere price fluctuations, encompassing transaction volumes, market sentiment, and investment patterns.

Mining Sector: Readying for the 2024 Halving

The halving event ushers in both opportunities and challenges for cryptocurrency exchanges. The reduced issuance of new Bitcoins could spur heightened demand for crypto assets, fostering bullish sentiment and price volatility. Nonetheless, crypto exchanges must ensure adequate liquidity to accommodate escalated trading activities, fine-tune trading algorithms, and apprise users of market disruptions.

As the 2024 halving looms closer, investors are advised to monitor pivotal metrics such as on-chain activity, exchange withdrawals and deposits, and ETF inflows. These metrics furnish valuable insights into market sentiment and the trajectory of Bitcoin’s price movements.

Market Predictions

Renowned author of “Rich Dad Poor Dad,” Robert Kiyosaki, recently proffered an optimistic forecast regarding Bitcoin’s future price trajectory. Kiyosaki envisions Bitcoin scaling to $100,000 by September. This projection comes against the backdrop of global economic turbulence and mounting debt concerns, particularly in the United States, China, Japan, and Germany.

Kiyosaki’s bullish stance on Bitcoin is underpinned by his analysis of the prevailing global economic landscape. He underscores various factors contributing to financial instability, including the massive debt burden in the United States, China’s troubled real estate market, and economic hurdles encountered by Japan and Germany.

Moreover, Kiyosaki draws attention to worrisome aspects such as consumer dependency on credit cards, the precarious state of banks, and looming global conflicts. In his assessment, these economic challenges underscore the necessity for alternative investment avenues.

I am purchasing an additional 10 Bitcoins before April. Why? The “Halving.” If owning a whole Bitcoin is beyond your means, consider acquiring 1⁄10 of a coin through the new ETFs or Satoshi’s.

If the Bitcoin protocol operates as intended, you may possess an entire Bitcoin by year-end.

I…

— Robert Kiyosaki (@theRealKiyosaki) March 25, 2024

Minimal Impact on Bitcoin Price

Despite the anticipation surrounding the halving, its impact on Bitcoin prices may be marginal owing to the already low issuance rates. While the event could stimulate heightened demand and media attention, its influence on supply dynamics is waning, suggesting a subdued correlation between halving events and market trends.

Meanwhile, a Cointelegraph report underscores the growing optimism among market analysts regarding Bitcoin’s long-term trajectory. Bitcoin’s existing price, currently surpassing \(66,000, has elicited bullish forecasts. Analysts are envisioning a potential upsurge exceeding 160%, propelling the price to eclipse \)150,000.

Bitcoin Price in the Past Week. Source: CoinMarketCap

Despite this optimism, apprehensions loom over accumulated selling pressure stemming from Bitcoin’s recent all-time high before the halving. Arthur Hayes, the Co-Founder of BitMEX, has cautioned about a probable price downturn during the halving period due to the Federal Reserve’s quantitative tightening measures.

Nevertheless, amid these uncertainties, the pivotal role of Bitcoin ETFs in propelling the cryptocurrency’s price rally cannot be underestimated. These ETFs have amassed a substantial portion of Bitcoin’s circulating supply, with recent data indicating noteworthy net inflows.