Bitcoin experienced a 1.4% increase in value over the last 24 hours, reaching $65,917.5 by 01:19 ET (05:19 GMT). The alleviation of tensions in the Middle East contributed to a boost in risk appetite, yet the cryptocurrency remained firmly within a defined trading range established in the previous month.

Over the weekend, Bitcoin underwent a halving event, resulting in a reduction of mining rewards on the blockchain, although this did not significantly impact its price movement.

During this period, the Runes protocol was introduced on the Bitcoin blockchain, enabling the creation of digital tokens. This initiative was spearheaded by Casey Rodarmor, known for launching the ordinals protocol that facilitated the minting of non-fungible tokens on the blockchain.

Distinguishing itself from ordinals, runes empower users to generate new tokens, akin to the functionality observed on the Ethereum blockchain.

The unveiling of the protocol triggered a notable surge in Bitcoin transaction fees, soaring sevenfold over the weekend. Data from Blockchain.com revealed a peak fee of nearly \(130 on April 20, subsequently stabilizing around \)35 by Monday.

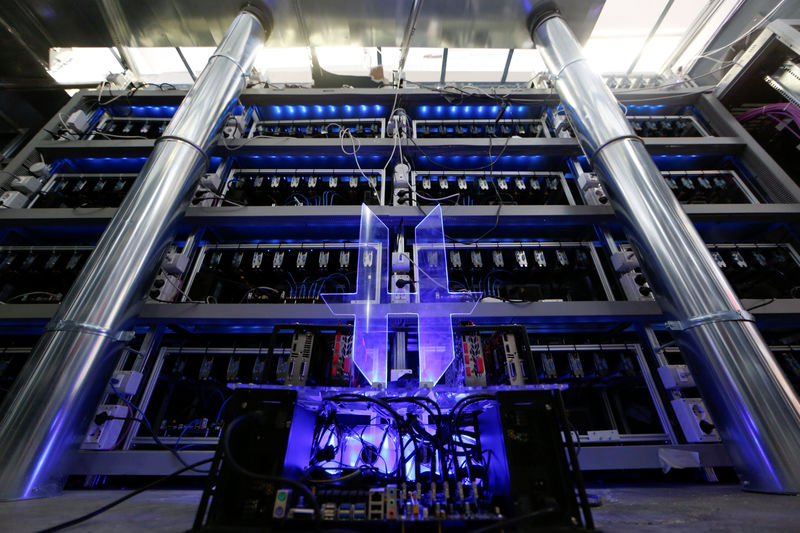

The surge in transaction fees is expected to benefit Bitcoin miners, despite traders largely overlooking the impact of the halving event on mining rewards during the weekend.

Although the halving event is projected to exert pressure on miners in the long term, mining stocks such as Marathon Digital Holdings Inc (NASDAQ:MARA), Hut 8 Corp (NASDAQ:HUT), Riot Platforms (NASDAQ:RIOT), and Core Scientific Inc (NASDAQ:CORZ) could witness short-term gains due to the increased transaction fees indicating higher revenues for miners.

While other prominent cryptocurrencies saw modest gains on Monday amidst improved risk sentiment following reduced concerns regarding a potential Iran-Israel conflict, the strength of the dollar and the anticipation of prolonged higher U.S. interest rates constrained significant upward movements in crypto prices. This environment also tempered Bitcoin’s price performance despite heightened on-chain activity.

Ethereum, the second-largest cryptocurrency globally, saw a 1.1% rise to $3,208.95, with XRP and Solana registering gains of 1.8% and 0.5% respectively.