Watch Daily Schedule:

- Monday – Friday, 3 PM ET

Bitcoin Update:

Bitcoin experienced a slight rise at the beginning of the week following the completion of its fourth halving on Friday. This event resulted in a reduction of incentives for bitcoin miners. The current price of the cryptocurrency stands at \(65,891.28, marking a 1.8% increase, as reported by Coin Metrics. Additionally, Ether saw a 1.5% increase, reaching \)3,198.06.

Cryptocurrency Miners’ Performance:

Publicly traded cryptocurrency mining companies witnessed a boost in their stock prices in the premarket on Monday. This surge followed a rally at the end of trading on Friday before the halving event. Marathon Digital and Riot Platforms, two prominent miners, observed gains of approximately 3% and 5% respectively. Similarly, CleanSpark and Iris Energy experienced increases of 3% and 4% respectively.

Insight into Bitcoin Halving:

The Bitcoin halving occurs approximately once every four years, reducing the rewards granted to miners by half. This protocol, embedded in the Bitcoin code, aims to decelerate the issuance of bitcoins, fostering a sense of scarcity and upholding the cryptocurrency’s digital resemblance to gold.

Market Expectations and Preparations:

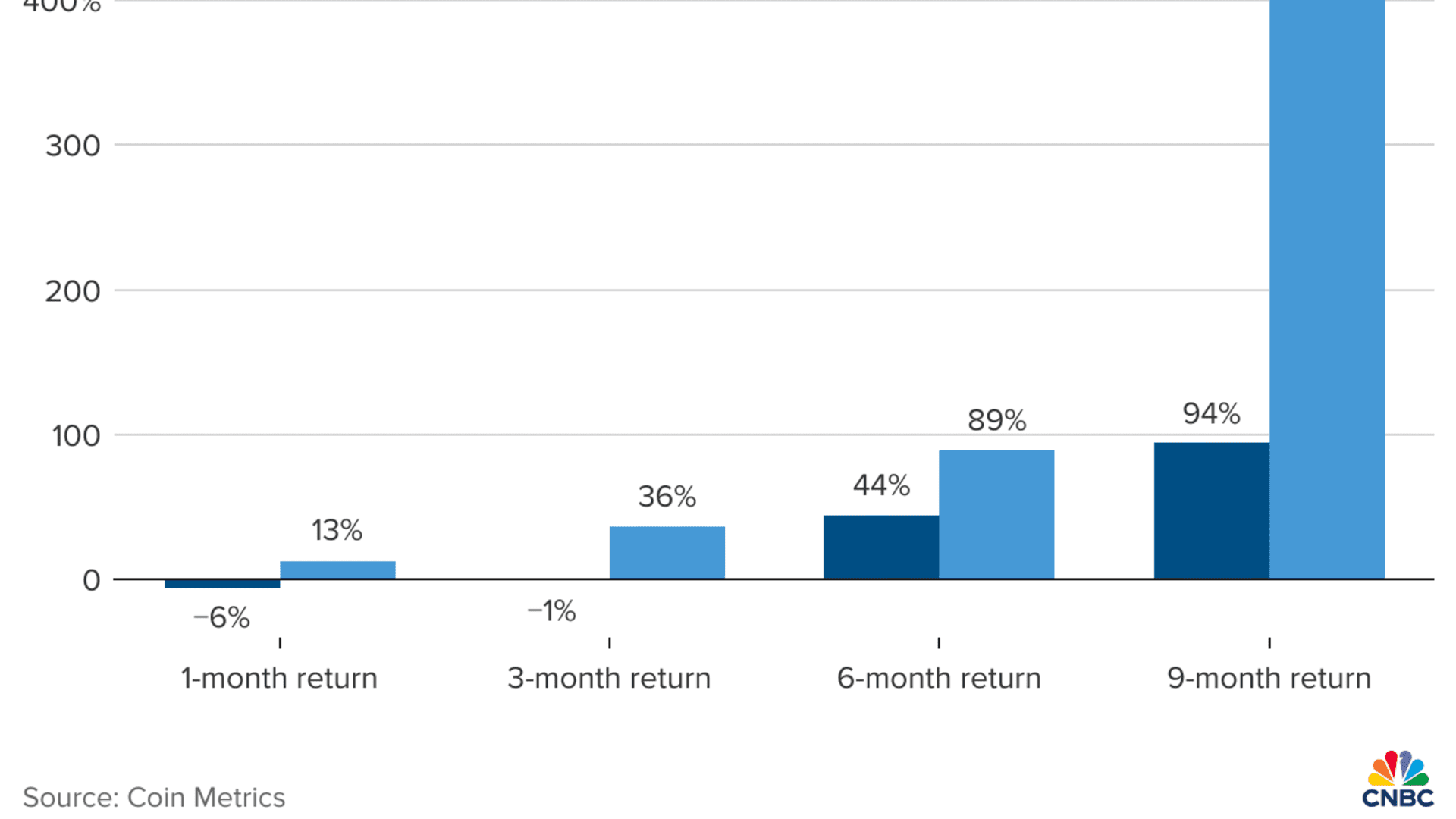

While many investors anticipated minimal price fluctuations surrounding the halving, historical trends suggest that it may take several months for the impact to manifest in bitcoin’s price. Despite this, JPMorgan warned of potential short-term downside risks for bitcoin.

Mining Operations Readiness:

Major publicly listed bitcoin mining ventures have proactively braced themselves for the halving. These preparations include substantial investments in advanced mining equipment, scaling up electricity capacity, and boosting hash rates, which gauge miners’ computational efficiency.

Implications for Smaller Operations:

Smaller and less efficient mining entities face the threat of shutdown post-halving. This scenario could potentially consolidate market share among the surviving miners and create opportunities for mergers and acquisitions (M&A).