The Australian Securities Exchange (ASX) has reportedly discontinued its endeavor to implement blockchain technology in its software overhaul, pivoting instead towards traditional solutions. This constitutes a notable shift away from a highly lauded concept that gained visibility in tandem with the rise of cryptocurrencies.

The ASX spurred discontent among market players back in November 2022 when it announced a “pause” on the revamp of its wide-ranging trading, settlement, and clearing software, initially intended to be built on decentralized computing. A third-party review found that after seven years of development, significant reworking was necessary.

Following the pause, indications were that the company was exploring other options for a fresh stab at modernizing its three-decade-old software. Nevertheless, during a meeting with stakeholders on May 17, it was revealed that the company had no plans to employ blockchain or any comparable distributed ledger technology (DLT) in the new design.

When asked about the direction for the next phase, project director Tim Whiteley reportedly said during the meeting that while the exchange was considering all options, it would most likely need to rely on more conventional technology to reach the intended business objectives.

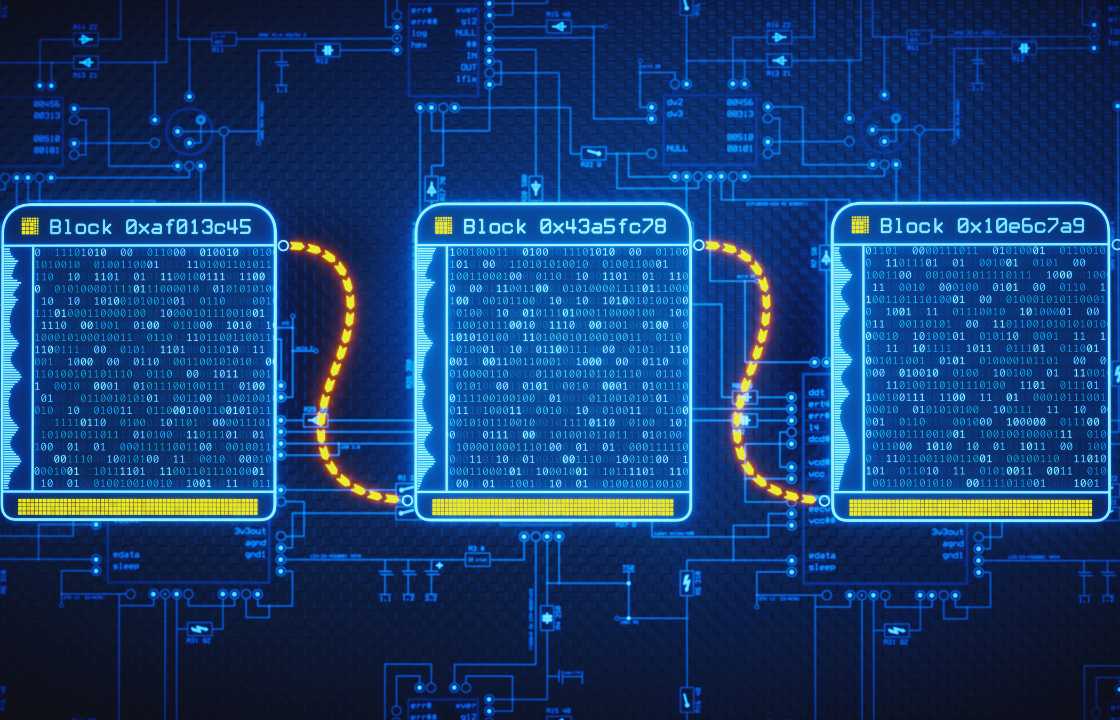

This announcement essentially marks the end of a project that was anticipated to be one of the most significant instances of a concept aimed at facilitating online transactions via secure processing across various locations.

ASX had been on track to become the first global securities exchange to integrate blockchain technology into the core operations of its services, in collaboration with New York-based tech provider Digital Asset. After commissioning Digital Asset for the software revamp in 2016, ASX had even purchased a minority stake in the company.

In the course of the meeting, Whiteley informed stakeholders that ASX was making headway towards finalizing a new strategy by year’s end. He noted that the company had solicited information from potential software suppliers and called for proposals from interested entities to garner more detailed feedback.

The ASX had received comments from market players favoring a less precarious approach, advocating against an abrupt switch to new software on a single day. Whiteley confirmed that these insights had been taken into account during the planning process for the new implementation strategy.